Tumult at FDIC; How a Trump Win Could Shake Up Regulators; CAT Fight

Capitol Account: Free Weekly Edition

The August quiet in Washington was interrupted this week by an internal squabble at the FDIC over (you probably guessed it) investigating complaints against senior officials. The partisan spat occurred behind closed doors, but one of the Republican board members went public with an unusually personal and combative statement. With the presidential campaign heating up, we also took a look at how a Donald Trump victory could impact the financial regulators — a key target in the so-called deep state that conservatives want to see dismantled. Lastly, we chronicled the wide range of support for a lawsuit that is seeking to halt the Consolidated Audit Trail, an enormous database overseen by the SEC that tracks stock trading in U.S. markets.

Thanks for reading our digest of articles published this week. The daily newsletter had more stories that you won’t find anywhere else. Use the button below to subscribe.

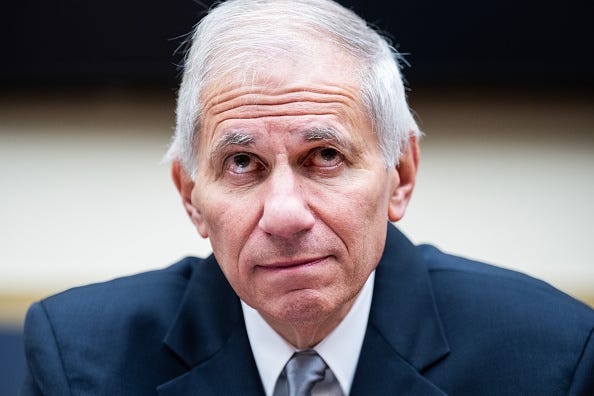

Gloves Off: The beleaguered FDIC, still led by Martin Gruenberg despite widespread calls for his departure, is struggling through yet another internal fight over how to clean up its toxic workplace mess. The latest imbroglio was sparked by Republican Director Jonathan McKernan, who released an unusually personal and combative statement this morning that, in so many words, accused his Democratic colleagues of shielding the chairman from investigations.

The details are a bit process-y and somewhat shrouded, but McKernan was clearly fuming after the five-member board, in a non-public vote yesterday, rejected his proposal for establishing new procedures for probing misconduct allegations against senior officials. The dustup, McKernan emphasized, “shouldn’t distract from the basic truth here…We will continue to struggle with accountability until we have a fresh start at the FDIC.”

Democrats instead adopted their own plan, the details of which weren’t released. But at least according to McKernan, the process will make it harder for the agency to review complaints about Gruenberg himself.

“To be more concrete, if also blunt, the debate here comes down largely to the allegations against the chairman,” McKernan said, pointing to accusations of verbal abuse leveled against Gruenberg. The statement also took pains to rehash some of the more colorful details laid out in the April Cleary Gottlieb Steen & Hamilton report. And McKernan cryptically noted: “There are also other incidents involving the chairman not described in” the law firm’s findings.

Gruenberg didn’t comment, but Democratic board member Michael Hsu, the acting comptroller, fired back with his own pointed commentary. “The proposal adopted by the board today provides a clear path for executives and board members to be held accountable in a timely and fair manner,” Hsu wrote. “I was surprised by Director McKernan’s objection, as his counterproposal distracts from our substantive goals.” (An OCC spokeswoman declined to elaborate on what exactly constituted a distraction. The two other FDIC board members, Travis Hill and CFPB chief Rohit Chopra, declined to comment.)

To many, the new dispute serves to underscore how far the once-staid bank regulator has veered off course after the high-profile scandal. The FDIC board has of late resembled a mudslinging congressional committee – complete with party-line votes, leaks about closed-door meetings and personalized attacks.

While the Republicans have often been the ones to first speak publicly about the disagreements (and certainly have political incentive to highlight Gruenberg’s troubles), they are not alone in feeling incredulous about the state of the agency. Few members of Congress in either party, to say nothing of the agency’s employees, have confidence that Gruenberg is the best man to clean up problems over which he presided for so many years.

Yet he remains in the top job, and is proceeding with a contentious agenda to boot. After last month’s busy board meeting, full of 3-2 party-line votes, Gruenberg, rather than the policy issues at hand, took the spotlight.

“Your continued efforts to push through partisan policymaking does a disservice not only to the FDIC, but the member institutions and the customers it serves,” GOP members of the House Financial Services Committee wrote in a letter to the chairman earlier this month. “Moreover, it further confirms that your commitment to improving the FDIC’s general toxic culture was merely a thinly veiled effort to keep power.”

Gruenberg remains a crucial vote for Democratic policy priorities, especially Basel endgame, and has said he won’t step down until a successor is confirmed by the Senate. With election season fast approaching, there’s still no word from the Banking Committee about a vote on the Biden administration’s new nominee for the post, CFTC Commissioner Christy Goldsmith Romero.

Stepping back: For those curious about the minutiae that sparked this fight, there won’t be much in the public record to review. The FDIC said the board will not be publicizing the text of the resolution at issue, citing the fact that it was considered in a closed session. But here’s a bit more background, gleaned from FDIC sources…(Thursday)

Click here to subscribe and read the rest of the article.

Thanks for reading. Follow us on X @CapitolAccount and on LinkedIn by clicking here. We’re always looking for stories, so if you have any suggestions on what we should cover (or comments about Capitol Account), shoot us a note. Rob can be reached at: rschmidt@capitolaccountdc.com and Ryan at rtracy@capitolaccountdc.com. If somebody forwarded this to you and you’d like to subscribe, click on the button below. Please email for information on our special rates for government employees, academics and groups: subscriptions@capitolaccountdc.com

Gaming Out a GOP Victory: If Trump wins a second term in November, many in official Washington will immediately be forced to look for new work. Historically, some of the top financial regulators have been an exception, especially in the bank policy world where the heads of the Fed and FDIC often stayed on to complete their terms. These days, that kind of smooth transition looks a lot less certain – and not just because MAGA believers want to root out the so-called deep state.

For one thing, polarization now permeates financial oversight and today’s political winds are more akin to hurricane-force gales. Just ask Jelena McWilliams, the former FDIC chief pressured out of her job in late 2021 with about 18 months left on her term. She and other Trump appointees were largely replaced by progressives. So the next Republican administration would have even more motivation to do an extensive house cleaning.

Perhaps more importantly, the legal ground has shifted to the right with recent Supreme Court decisions handcuffing agencies and boosting the power of the president. Conservative activists – and judges – have grown less friendly to the independence of federal regulators, lending momentum to the idea that a commander in chief (particularly one fond of saying, “You’re fired!”) can and should remove Senate-confirmed appointees upon taking office.

“Until roughly 15 years ago, the idea that you could have an independent federal agency or department head was not controversial,” says Kent Barnett, dean of the law school at The Ohio State University. “It has gotten much more complicated.”

In recent cases involving the CFPB and FHFA, the high court has made clear that the president can oust the heads of independent agencies led by a single person. That means Rohit Chopra and Sandra Thompson’s days would be numbered in the event of a Trump win. Comptroller Michael Hsu’s tenure also would likely be short, given his acting status.

But even at multi-member commissions like the SEC, the landscape is cloudier than during previous transfers of power. Capitol Account reached out to sources across the government and the legal world to ask what might happen if Trump returns. The upshot: plenty of speculation about some odd scenarios. What follows is our look at how key Biden administration officials overseeing Wall Street might be in for a bumpy ride if the GOP retakes the White House.

SEC: The game theory around Gary Gensler’s future has been a hot topic this summer, on Wall Street and in Washington. Typically, the head of the SEC exits when the president of a different party comes in, and that remains the most likely outcome, sources say. (Gensler is an institutionalist and would have plenty of good opportunities, especially in academia, outside of government.) Still, it doesn’t have to be that way.

That’s because all five members of the SEC are confirmed as commissioners; the president is responsible for designating one as chair. So Gensler, whose term ends in 2026, could in theory decide to keep this seat – just with a demotion. Is that a tinfoil hat construct? Maybe. But the chatter has already produced some real-world implications for his Democratic colleague, Caroline Crenshaw.

Some GOP senate offices, sources say, have wondered whether it would be best to keep her pending renomination in limbo until after the election, rather than risk the possibility of a three-Democrat majority that could thwart a Republican chairman and preserve Gensler’s policies, at least for a while.

Trump and his allies haven’t been shy about their desire to trim the administrative state. The former president, for his part, recently told a crypto conference that he’d fire Gensler immediately. That move might be a lot harder if the SEC chief decides to dig in as a commissioner. And a final answer – one that would be relevant for other agencies like the CFTC and FTC as well – likely needs to come from the courts.

At least some in the finance industry have posited that the issue is unresolved. “Whether SEC commissioners have removal protections is an open question,” argued the American Securities Association and conservative groups in a recent amicus brief filed in the lawsuit over the SEC’s climate disclosure rule.

FDIC: Legal questions about the extent of the president’s removal power have in the past turned on a key distinction. If the president is firing an official “for cause” (say, improper conduct in office), that’s one thing. If the ouster comes purely over policy differences, that’s another matter.

Consider the FDIC, where it’s not quite clear who will be in charge come January 2025. If Gruenberg sticks around and Trump wins, Republicans would have obvious reasons for the longtime chair’s removal before his term expires – the recent scandal over sexual harassment and a toxic workplace.

But if Goldsmith Romero is confirmed to a five-year term before Trump takes office, that would create an entirely different situation. She would have just started the job with presumably no cause for her removal. So the question would shift to whether the president can remove a Senate-confirmed FDIC leader simply for policy reasons. That goes back to how the courts view independent agencies.

The relevant case law starts with a 1935 decision called Humphrey’s Executor in which the Supreme Court said Congress can limit the president’s power to fire members of the FTC at will. Legal experts have long seen that precedent as also protecting top officials at the Fed, SEC and FDIC, except in cases of “inefficiency, neglect of duty or malfeasance in office” (to quote the statutory language at issue).

Perhaps not for much longer, however. Conservative legal minds believe that the high court has been chipping away at Humphrey’s, and many see a case involving the Consumer Product Safety Commission as a potential knockout blow…(Wednesday)

Click here to subscribe and read the rest of the story.

CAT Fight: When the New Civil Liberties Alliance sued to quash the SEC’s Consolidated Audit Trail earlier this year, the anti-administrative state group memorably likened the program to a Panopticon – a prison where inmates can be surveilled at all times by a single observer. The ominous-sounding description seems to have hit home.

In recent days, conservative organizations, business associations, a former U.S. attorney general, 19 states and even crypto firms have jumped into the fight in a Texas federal court. Their support of the challenge, laid out in seven new amicus briefs, is unusual for a case at the trial level. It’s a sign that the vast database of stock trades, which has been highly controversial but rarely garnered attention outside the brokerage industry, is now galvanizing a much wider contingent of opponents.

Some of the filings argue that the collection chills freedom of speech or violates constitutional protections against unreasonable search and seizure. Others contend that the SEC doesn’t have the authority for creating such a massive system that could put the private information of more than 100 million investors at risk. Many see the CAT as emblematic of the alleged government overreach that the Supreme Court’s conservative majority has been looking for opportunities to rein in.

“Federal regulatory agencies are circling this case like jackals, watching to see if this court will allow them to tear away at powers the Constitution reserves only to Congress, or the people,” notes a brief from Advancing American Freedom, a non-profit founded by former Vice President Mike Pence. Building on (or maybe surpassing) the Panopticon rhetoric, it labels the effort an “unconstitutional chimera” created by “hacking off powers from one branch of government and monstrously grafting them on to parts of others, while amputating various parts of the Bill of Rights.”

Former Attorney General William Barr, who signed onto an amicus with the American Free Enterprise Chamber of Commerce and the American Securities Association agrees. The SEC, the brief states, tries “to paint the Consolidated Audit Trail as a mundane enforcement program that raises few legal and privacy concerns. Not so.”

NCLA brought its suit in April on behalf of two investors and a free-market think tank. Its focus, says Peggy Little, a senior counsel with the group, is on the constitutional issues and the SEC’s lack of legal authority. The CAT, she adds, “violates so many different concepts, precedents, doctrines – that alone makes the case for why this can’t go forward.”

Last month, the SEC asked the court to throw out the lawsuit, arguing that it comes way too late – some 12 years after the audit trail was first approved – and that the challengers don’t have standing. “In a nutshell, the Consolidated Audit Trail is critically important to the government and the securities industry, enabling cross-market securities monitoring to detect wrongdoing and protect investors,” the agency emphasizes.

In addition, the SEC points out that the “minimal personal information (name, address, and birth year)…is stored separately from transactional data with only limited access for a small set of individuals on a need-to-know basis” and “would still be collected by self-regulatory organizations and broker-dealers” if the CAT is shut down.

What follows are a few of the other points raised in the amicus filings…(Tuesday)

Click here to read the rest of the article.