Talking Open Banking; Nomination Whipsaw; SEC and CFTC Pledge to Streamline Rules

Capitol Account: Free Weekly Edition

This week’s government shutdown slowed the news in financial regulation. The SEC and CFTC kept a skeleton crew on hand to monitor the markets, but most of their staff were sent home. The banking regulators and the CFPB, which don’t rely on congressional appropriations, remained open.

Before the impasse, the White House made some long-awaited moves on the nominations front, sending two agencies in very different directions. We also covered a public roundtable where the heads of the SEC and CFTC pledged to “harmonize” their rules. A contentious panel discussion featuring the CEOs of exchanges showed some of the roadblocks that lie ahead. There was even a middle finger flashed by CME’s Terry Duffy, who didn’t take kindly to being called old by Polymarket’s Shayne Coplan.

Finally, we reported on two long-festering fights, one over the SEC’s troubled (and expensive) program for surveilling stock trades and another involving the CFPB’s supervision of non-banks. For our Friday interview, we talked with a veteran fintech executive about the administration’s plans to redo regulations on sharing customers’ financial information.

Thanks for reading our digest of articles published this week. Click the button below to become a paid subscriber and get our full coverage.

Friday Q and A: Just about a year ago, the CFPB adopted its open banking rule, a landmark step that was supposed to settle long-running arguments about how financial firms must share customers’ data. Instead, it was just the beginning of another torturous fight.

Big banks sued. Fintech upstarts, which largely supported the plan, punched back in court. And the new Republican-led consumer bureau seemed inclined to take banks’ side – until crypto boosters jumped into the fray. By summer, the Trump administration decided to start the entire rulemaking process over again, leaving everyone guessing about what will happen next.

To try to make sense of the morass, we sat down with a fintech leader at the center of the debate. As chief advocacy officer for MX, a firm that provides data sharing services and also sells software used in mobile banking, Jane Barratt is talking with both regulators and other companies about how to sort things out. And like many on the technology side, she’s not thrilled with where industry practices are heading.

Read on to learn Barratt’s take on why some banks are on the wrong side of the issue – as well as her dire prediction about the impact on competition if their view takes hold. She also discusses the work ahead for policy makers on artificial intelligence. What follows is our (lightly edited and condensed) conversation.

Capitol Account: Give us a quick synopsis of your career.

Jane Barratt: I’ve been with MX for seven years now. Prior to that, I was a fintech founder, and MX was actually my data provider…My first career was in marketing, media, advertising, especially from the tech side.

CA: What did the company you started do?

JB: We were a registered investment adviser, I was personally an RIA as well. It was investing for beginners, and it would look at people’s transaction history – show us where you shop, we’ll build your portfolio. [We would] say, `You spent $10,000 at Amazon last year, I’m guessing maybe you could buy one of their shares.’

CA: That must have brought you into contact with the financial regulators in Washington.

JB: I argued with the SEC and Finra that I was a data company, not an investment adviser. It did not go well.

CA: Was it similar when you joined MX?

JB: It was still very early days. [Regulators were asking], `What do we do with this? It’s clearly an ecosystem that is growing.’ So I got very involved, especially with the [Consumer Financial Protection] Bureau, but I also spent a lot of time with the OCC and the FDIC.

CA: What were you telling them?

JB: I was just doing education, [explaining that] this is not some abstract thing that’s happening in the future. What people are doing now is logging in with their credentials and sharing their data…to apply for a loan. There was enough momentum in the industry…to know we needed better frameworks, both regulatory frameworks as well as technology frameworks.

CA: How do you explain MX’s business?

JB: We turn data into action. We work mostly with financial institutions and some fintechs and we do data services and software as a service…We have clients like Boeing Employees’ Credit Union, like Hancock Whitney that are big enough that they want something amazing and custom, but they’re not trillionaires that can build everything themselves. So they’ll use our software to bring a great experience to life with their customers.

CA: What about the data side?

JB: We found very quickly that the world of financial data is written for machines, not for humans.

CA: How so?

JB: If you go and have a look at your transaction list or your statement, it usually [says something] like SBX-1275 Texas. And you say, `What? I wasn’t in Texas.’ But [actually] it’s a Starbucks [purchase]. We take the machine readable data and turn it into human readable. That’s been a huge part of our business – for giant top-10 banks down to teeny tiny little community banks – just making what people are doing with their money more transparent to them, and frankly more transparent to the companies that serve them.

CA: Data sharing can be very technical. Why should people care about the CFPB rule?

JB: We’ve always come at open banking from the perspective of what is right for humans – how can they actually improve their own financial outcomes through technology, and frankly, through competition? If they’re not getting what they need from their current provider, they should have the opportunity to work with another.

CA: Congress told the CFPB to write data sharing rules in the 2010 Dodd-Frank Act. Banks, however, contend the law doesn’t require them to provide information to third-party apps, especially for free.

JB: Congressional intent was [that] consumers and representatives, `upon request,’ should be able to access their data. Did that mean paying a massive toll? No. Did it mean [banks share with whom they] choose? No.

CA: What did you think of the regulation adopted under Rohit Chopra?

JB: I can’t say it was a perfect rule. It was one of those ones where all sides were unhappy with different things…But we were absolutely supportive because, what’s the alternative?

CA: The Trump administration initially agreed with all the banks’ arguments in their lawsuit seeking to vacate the regulation. But now they are re-opening the plan for public comment. What’s your sense of where the policy is headed?

JB: It is more future-facing. They’ve widened the aperture to start thinking about things like digital assets, cryptocurrencies, stablecoins…They are very ambitious with their timeframe in terms of wanting to get feedback on what needs to be changed in the rule…(Friday)

Click here to subscribe and read the full interview.

Thanks for reading. Follow us on X @CapitolAccount and on LinkedIn by clicking here. We’re always looking for stories, so if you have any suggestions on what we should cover (or comments about Capitol Account), shoot us a note. Rob can be reached at: rschmidt@capitolaccountdc.com and Ryan at rtracy@capitolaccountdc.com. If somebody forwarded this to you and you’d like to subscribe, click on the button below. Please email for information on our special rates for government employees, academics and groups: subscriptions@capitolaccountdc.com.

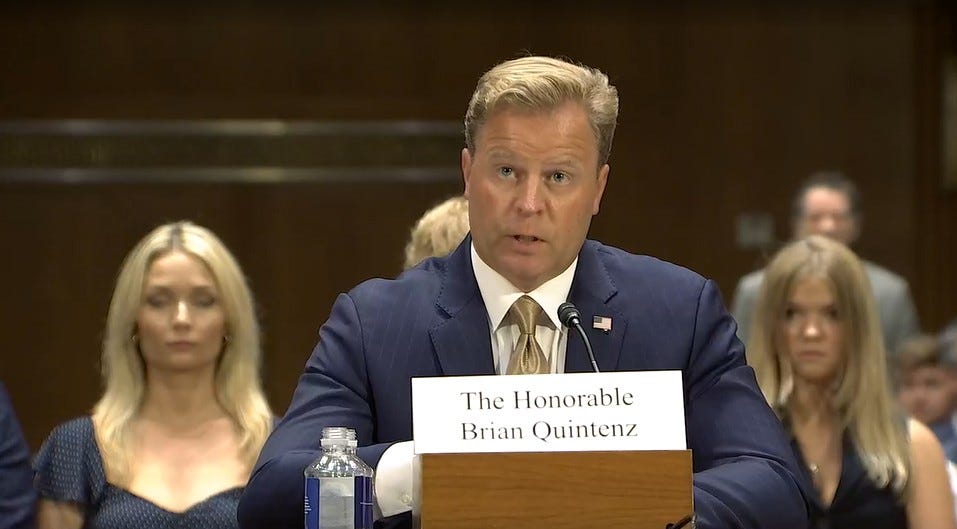

A Tale of Two Nominations: Donald Trump’s governing style often feels like a contest between order and chaos, and this week’s whipsaw of financial regulatory nominations has been a prime example. At the CFTC, uncertainty reigns after the White House formally gave up on Brian Quintenz, who had broad backing and once looked like a shoo-in for the agency’s top job. Meanwhile, the president chose continuity at the FDIC, tapping an acting chairman who’s already moving full-steam ahead with the administration’s agenda.

Travis Hill’s promotion was hailed by the banking industry, which has spent months quietly lobbying for his appointment. The nomination, sent to the Senate Tuesday night, paves the way for him to finish filling a number of senior staff vacancies and to get rolling on his mission of regulatory right-sizing.

But Hill has hardly been sitting around. The former FDIC vice chairman and Jelena McWilliams staffer had already won some key endorsements on Capitol Hill and impressed Treasury Secretary Scott Bessent’s team during work on proposed changes to the supplementary leverage ratio, a top administration priority.

Hill’s calendar shows he’s been huddling regularly with fellow regulators at the Fed and OCC as the agencies try to move the ball forward on stablecoins, capital rules and other top issues. Also on the schedule in recent weeks were state banking associations, the CEOs of Comerica and Citizens Bank, ICBA’s Rebeca Romero Rainey and ABA’s Rob Nichols.

Still, the name that cropped up the most was Carrie Cohen, the Morrison Foerster partner who has met with Hill upwards of eight times in the last six months as the independent monitor overseeing the agency’s “cultural transformation.” It’s a reminder that the FDIC job comes with a lot of unfinished internal business as well.

Tuesday night’s withdrawal of Quintenz’s nomination finally ends one of the more bizarre episodes in the financial regulation realm – one that began with the former CFTC commissioner emerging as a consensus pick who could garner support from both the crypto industry and Wall Street firms. He was set to lead the agency at a moment when it was being thrust into the spotlight, poised to gain new authority over digital assets and set rules for the burgeoning event contracts market.

Quintenz sailed through a Senate hearing in June where Republicans praised his credentials and gave the impression he’d be quickly confirmed. A little more than a month later, it was clear that his candidacy was in trouble. Opposition from gaming interests due to his work with Kalshi, the event contract exchange, provided an initial snag. But a fracture in the digital assets industry may have been the coup de grace. The fight, pitting Cameron and Tyler Winklevoss against Quintenz, was like watching a car crash in slow motion. And it was hard to look away.

The founders of crypto exchange Gemini personally registered their complaints with Trump. Quintenz countered by releasing some of their personal correspondence on social media – suggesting the brothers were opposing him out of self-interest and arguing that the president had been “misled.” Many saw his move to take the spat public as a final attempt to salvage his nomination, a view that proved correct…(Wednesday)

Click here to subscribe and read the full story.

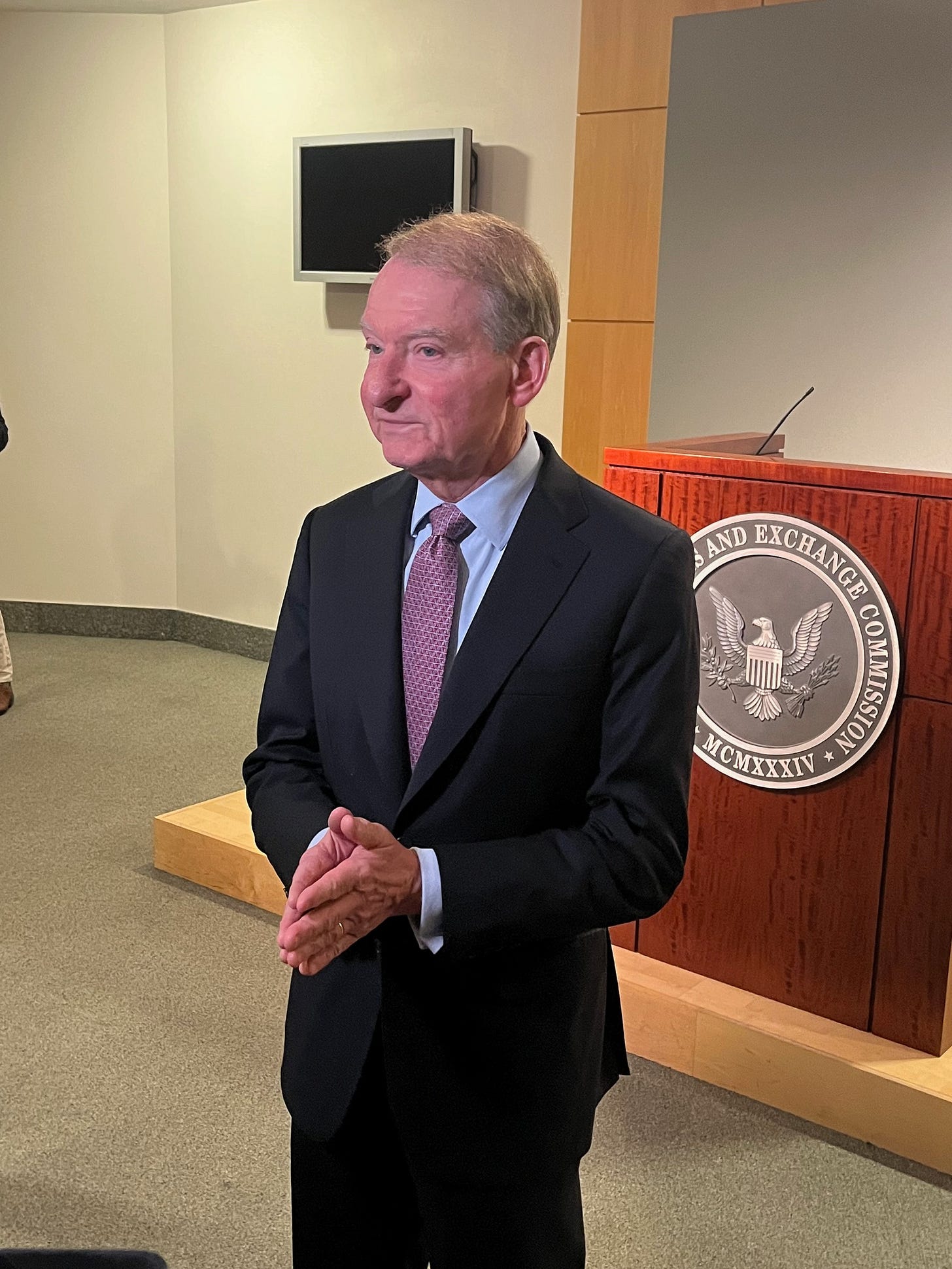

Challenges Ahead: Market participants of all stripes – and ages – crowded into the SEC’s Washington headquarters Monday afternoon to listen to the heads of the SEC and CFTC extol the virtues of “harmonizing” their rules and ending “regulatory fragmentation.” While the rhetoric at times soared and most everyone credited the agencies’ leaders for trying, it wasn’t obvious how they would overcome the longstanding challenges caused by their adjacent, often overlapping mandates. One thing that was clear, however, was that industry giants and their crypto competitors have different views on the finer points.

“Today, I believe, marks a turning point in the history of American financial markets,” SEC Chairman Paul Atkins told the crowd. “For too long, the SEC and CFTC have operated in parallel lanes, too often in conflict with one another, leaving the American public to bear the costs of duplication, delay and uncertainty. That era is behind us.”

His counterpart, Acting Chairman Caroline Pham, even borrowed one of the SEC chief’s favorite phrases to underline the point. “It’s a new day and the turf war is over,” she said. Still, with the commodities overseer having no permanent leader and four vacancies on the five-member commission, Pham felt the need to provide some assurance that the regulator was up to the task. “The CFTC is alive and well,” she said, offering some statistics on its policy work this year. “There needs to be no more FUD about what’s going on.” (The acronym, popular with the digital assets crowd, stands for “fear, uncertainty and doubt.”)

Atkins also took pains to say that the public roundtable wasn’t a harbinger of an attempt to combine the two agencies. “Let me be clear, our focus is on harmonization, not on a merger of the SEC and CFTC, which would be up to Congress and the president,” he said. “Fanciful talk of reorganizing the government risks distracting us from the monumental opportunity we have in front of us.”

Speaking to reporters after his remarks, Atkins underscored that he isn’t worried about a leadership vacuum at the sister agency. Pham “is being very collaborative with us and I have a lot of confidence in her,” he said.

The chairman added that dealing with crypto oversight will be “job one” for the two commissions. “We are in sync,” he said. “I didn’t come to take this job to engage in a turf battle, that’s really the last thing on my mind.”

But even if the agencies are on the same page, some of the back-and-forth among the event’s speakers showcased how difficult it may be to streamline regulations – especially when established, influential companies have built businesses around them. Exhibit A was a panel discussion of trading platforms that featured traditional exchanges and crypto-focused upstarts.

ICE CEO Jeffrey Sprecher set the tone when he pointed out that there were plenty of regulatory constraints that he would like to see removed, but noted that he can’t simply ignore the status quo of legal obligations. “We cannot tolerate receiving a Wells [enforcement] notice, we cannot tolerate the FBI showing up at senior executives’ homes – because our shareholders will not allow that,” he said in what seemed to be a pointed reference to some of the troubles in the digital assets industry…(Monday)

Click here to subscribe and read the full article.