Talking Gensler and the CFTC; SEC Chief Tosses Brushback Pitch at Coinbase; Ex-Solicitor General Readies Grayscale's Arguments in ETF Case

Capitol Account; Free Weekly Version

We sat down this week to talk to a former CFTC commissioner who spent a lot of time with Gary Gensler when he ran the commodities regulator and was crafting dozens of new rules for swaps in the wake of the financial crisis. She had some fascinating insights on what’s going on now with the SEC’s massive regulatory push. Crypto (of course) was in the news, and we looked at a dust-up involving Gensler and the major trading platform Coinbase. Lastly, Grayscale Investments has a big court date coming up next week in its fight to offer a Bitcoin exchange traded fund. We met the asset management firm’s appellate lawyer — who only eats a certain dinner the night before an argument. Whatever you think of superstitions, this one has worked out pretty well for him over the years.

Thanks for subscribing to our free edition, where you get a selection of abbreviated stories we featured this week. Capitol Account is published daily and has a lot more coverage of the agencies and lawmakers driving financial policy in Washington. If you like what you see, we’d love to have you subscribe to our paid newsletter.

Friday Q and A: There are few people in Washington who know what it’s like to sit on a commission with Gensler and deal with an unprecedented flurry of new regulations. Jill Sommers is one of them. As a Republican CFTC commissioner from 2007 to 2013, she provided some of the loyal opposition as Gensler led the commodities regulator to enact dozens of new rules that brought over-the-counter swaps trading under federal oversight after the financial crisis. Ask her about it, as we did, and she’ll tell you it was exhausting.

But Sommers’ insights on the SEC chief aren’t the only reason we sought her out for an interview. The native Kansan is currently the chair of Patomak Global Partners derivatives’ practice group, but she has deep roots in the Washington financial regulatory universe. Sommers got her start as an intern on Capitol Hill for the late Senator Bob Dole before spending about six years at the Chicago Mercantile Exchange. She then was head of government affairs for the International Swaps and Derivatives Association.

Read on to learn her thoughts about the current state of the CFTC and the unusual attack by liberal group Better Markets on Chairman Rostin Behnam – as well as how she spends her time with no more kids in the house. We also delve into betting on elections and the recent CFTC move that left Kalshi’s event contracts up in the air. What follows is our (lightly edited and condensed) discussion.

Capitol Account: You started in the derivatives industry before the financial crisis put swaps on the map. What was that like?

Jill Sommers: When I joined the International Swaps and Derivatives Association, I was the only person in their Washington office…They didn't see a usefulness in having somebody in Washington when they were a global trade association. And geez, how wrong they were. Fast forward three or four years, and they were really, really in the frying pan.

CA: You were also a bit ahead of the curve when you landed at the CFTC in 2007, a year before things really blew up – both in the markets and at the agency.

JS: John Damgard, who was president of the Futures Industry Association, called me and said: ‘This is such an easy job. I guarantee you that you will be able to stay home with your kids, and go in once or twice a week to sign enforcement actions. You do nothing over there. Trust me.’ So, of course, for years I was like: thanks a lot.

CA: After Congress passed Dodd-Frank in 2010, the CFTC had a lot of very technical regulations to write. And Gensler was on a mission to get everything passed as soon as possible. What was it like?

JS: It was a grind. It was 60 hours a week – and it's the same sort of pace that you're seeing from [Gensler] out of the SEC. We would get 500, 700-page proposals a week in advance. And two or three at a time. He expected us to be reading them and voting on them. Then two weeks later, you had three more rules.

CA: You and your fellow Republican on the commission at the time opposed much of what Gensler was doing. What was your main concern?

JS: We should have started with: what is the definition of a swap and what is the definition of a swap dealer? And those were joint rules with the SEC. We should have made sure that we were on the same page with them at the very beginning. And then you could actually contemplate logical rules following those… We had already done probably a dozen rules before they defined a swap.

CA: From your experience at the CFTC, how do you think SEC workers are doing under Gensler?

JS: If you talk to anybody who's a career employee at the SEC, they've probably never in their career seen anyone like him. It's our understanding that a lot of the proposals [Gensler is putting out] are not even run through the staff and the divisions that typically would be writing those proposals. It's all out of his office. That is not surprising.

CA: CFTC workers unionized after Gensler left. The SEC’s union and management are completing a collective bargaining agreement that will bring employees back to the office at the end of March. But they can still work from home eight days out of 10.

JS: That is outrageous that the American taxpayer is paying the salaries of those people to show up to the office one day a week, two days a pay period…I would say 75 percent of the roles in these regulatory agencies are based on being there, being present, working with your colleagues next door. I don't understand how they get things done.

CA: Do you have any advice for businesses about how to deal with Gensler?

JS: No. Because I don't think that there's a path to success.

CA: How do you think Behnam has been doing as chairman?

JS: I think he has a really tough job. Never in the history of the commission have you had four new commissioners come in at the same time. You typically have a situation where he would naturally have some allegiance from commissioners that he's previously served with, or that he has had relationships with. Instead he gets four new commissioners – none of whom, I think, he has a real relationship with, and none of whom publicly seem to have any allegiance to him. You would think that at least the two Democrats would be giving him the benefit of the doubt on most of this stuff, but they are publicly undermining him at every turn…He's got to have three votes for anything he wants to do. I think it's pretty typical that he's reading in the press their views on things before they share them with him.

CA: The CFTC chair also has come under fire from the left, which is unusual since he is a Democrat. What do you make of these attacks by Better Markets and its president, Dennis Kelleher?

JS: There has to be something behind it. I would off the top of my head blame [Gensler] because those two are close. Shortly after Better Markets published the scathing review of Chairman Behnam, a week later or two weeks later, it prints this glowing review [of the SEC] that you make an assumption [Gensler] wrote himself. I've never seen anything like it.

CA: Plenty of people, inside and outside the CFTC, thought it was over the top. And they wondered if the critique had something to do with the crypto turf fight between the two agencies.

JS: I think it's wholly unfair…It keeps pointing to all of these ties to FTX, which frankly, I've never seen any of the sort of connections that Dennis Kelleher keeps claiming…It’s like he has some sort of personal issue with [Behnam]. And maybe it's because when [Gensler] was chair, Dennis Kelleher had a pretty good grip on – I don't know how to word this – influencing the direction of rules that the CFTC was doing. If Better Markets wanted something, they got it. Full stop. And perhaps [Behnam] has not played that game, so now he's in their ire because he hasn't caved to their pressure.

CA: Last fall, you joined the board of FTX’s U.S. derivatives subsidiary. Are you still on it?

JS: I am. LedgerX still exists. It is a fully collateralized, functioning exchange and clearinghouse that didn't have any issues. I make an assumption that somebody will buy them.

CA: Did you get to know Sam Bankman-Fried?

JS: For about three months…Super smart guy, and he had all of these ideas of how he was going to change the world.

CA: But that turned out not to be true.

JS: I'm sure you read all the stuff that he still publishes on his Substack. He says things like, `I messed up.’ But I think in his head he still thinks he's eventually going to change the world…(Friday)

Clapping Back at Coinbase: Reconfirming that he never shies away from a fight (especially in the crypto arena), Gensler moved to set the record straight after some prominent token trading platforms offered what the SEC chief felt were misleading assessments of a recent rule proposal. The pushback, a source told us, was particularly directed at Coinbase – a firm that Gensler has long had issues with and is under investigation by the commission’s enforcement division.

The origins of this latest dust-up date back to the middle of last month, when the SEC passed a plan that calls for investment advisers to boost safeguards for holding customer assets. It’s not a crypto-specific regulation, but most see it as applying to tokens – and some argue that it pretty much precludes major cryptocurrency exchanges like Coinbase and Gemini from being in the custody business for asset managers. Still, the proposal seemed to leave a bit of a gray area and both companies interpreted it to their advantage, publicly stating that the SEC proposal would not harm them.

Speaking at an SEC investor advisory committee meeting, Gensler mentioned no names, but took pains to stress that the firms’ interpretation was wrong. As he sees it, there is no gray area. “Based upon how crypto trading and lending platforms generally operate, investment advisers cannot rely on them today as qualified custodians,” he said. “To be clear: just because a crypto trading platform claims to be a qualified custodian doesn’t mean that it is.”

The second part of Gensler’s comment was intended as a direct response to Coinbase, the source underscored. Here’s what the firm’s top lawyer, Paul Grewal, said shortly after SEC commissioners voted Feb. 15 to seek public comment on the custody proposal: “We commend the SEC for recognizing Coinbase Custody Trust Co. is a qualified custodian, and after today’s SEC proposed rulemaking, we are confident that it will remain a qualified custodian.”

(Gemini’s Tyler Winklevoss tweeted a very similar comment, noting that the company “has been a fiduciary and qualified custodian under the New York Banking Law since 2015. This will continue to be the case under any new SEC rule that comes into effect.”)

Despite the SEC chair’s clarification, it’s not likely that this issue will go away soon. In fact, in a statement to Capitol Account, a Coinbase spokesperson doubled down:

“Coinbase Custody Trust Company serves as a qualified custodian under the SEC's Custody Rule, and the SEC's recent proposal does not change that. CCTC is an institutional custodian, chartered as a limited purpose trust company under the New York State Department of Financial Services. It's had an excellent track record and is an industry leader in custodial solutions.”

One big reason that the company is sure that it would comply with any new dictates is that its custody business is separate from its trading platform, one person said…(Thursday)

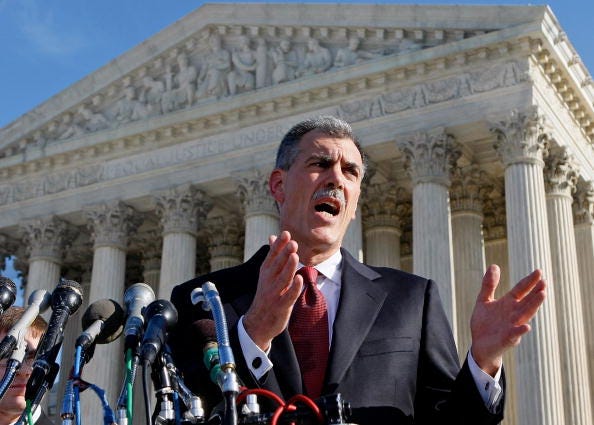

Grayscale’s Hired Gun: Consider the SEC forewarned: The night before he heads to the D.C. Circuit next week to challenge the securities regulator’s denial of Grayscale Investment’s bitcoin ETF, Donald Verrilli Jr. will be digging into a nice piece of salmon. The ritual, the former U.S. solicitor general says, has served him well over the course of more than a hundred arguments. That includes some major victories for the Obama administration, like convincing a conservative leaning Supreme Court to uphold the Affordable Care Act. Verrilli usually has it broiled, and the fish is already in his freezer. “When you have a superstition that’s been going for 20 years, you’re not going to mess it up,” Verrilli says.

Of course, the appellate specialist is also doing some of the more traditional prep, such as participating in court practice sessions. The case goes before a three-judge panel on March 7, and it should be a marquee event for those following the SEC’s efforts on cryptocurrencies. Grayscale’s trust is the largest bitcoin fund in the world, with nearly a million investors and about $15 billion in assets under management. The firm sued the agency last June after it denied a request to convert the fund to an ETF. (The SEC contends that the Grayscale can’t show that the ETF won’t be susceptible to fraud and manipulation.)

Verrilli, now a partner at the Munger, Tolles & Olson law firm, met Monday with reporters to lay out some of Grayscale’s legal reasoning and discuss the upcoming oral arguments. Not surprisingly, he predicted victory and said he didn’t think that the SEC would appeal. Grayscale, however, has said that option is on the table if it were to lose. Here are a few of Verrilli’s other thoughts:

A token novice: Since being retained by Grayscale last summer, it’s been a crash course in digital assets for the attorney. “To say I knew nothing about cryptocurrency before taking this case would be an understatement,” Verrilli says. Still, he notes that being a generalist is often a virtue. “I need to have people teach me in a way I can absorb, and then that allows me in turn to think about the best way to communicate to judges — who are going to be like me in the sense that they are not experts,” he says. “That process of translation, for me, is the key thing.”

Straightforward case: While the litigation is about a technical and somewhat novel investment product, Verrilli argues that it’s really about a “basic norm” that governs federal agencies – that they have to engage in reasoned decision making. The SEC’s acceptance of ETFs that hold bitcoin futures, while disapproving those (like Grayscale’s) comprised of spot bitcoin, violates that fundamental principle, according to Verrilli: “It’s just a classic case of taking like cases and treating them differently.”

One irony: Most businesses that take the SEC to court are trying to overturn its rules and escape oversight. Verrilli notes that Grayscale is asking that its bitcoin fund be subject to stricter regulation as an ETF – a point it will make to the D.C. Circuit. “This is an unusual case,” he says. “What we are really asking here is to move regulatory policy in a pro-investor direction.”

FTX blowback? While it’s impossible to know whether the massive turmoil in the crypto markets, and the high-profile collapse of FTX, will be in the back of the judges’ minds, Verrilli points out that the court should be focused solely on the administrative record. And that has nothing to do with the problems in the industry. “The FTX situation was basically a good-old-fashioned Enron-style fraud, it really wasn't about anything having to do with regulatory mechanisms” at issue in the case, he says.

Tough panel? Grayscale drew two Democratic appointees (Chief Judge Sri Srinivasan and Senior Judge Harry Edwards) and one Trump appointee (Judge Neomi Rao). According to some legal experts the two Democrats tend to be more deferential to federal agencies – meaning that the firm has an uphill battle on its hands. “I’m happy with this panel,” Verrilli says. “They are extremely careful, responsible judges.”

Salmon postscript: Verrilli says he started eating the fish before arguments some 20 years ago after seeing a TV show about how the oils in salmon “are really good for your brain” shortly before he was due to appear before the Supreme Court. His streak, he notes, had one dicey moment recently when he was at a hotel in Philadelphia where the restaurant (he had checked the menu in advance) ran out of salmon. Fortunately, he recounts, when he ordered room service the next morning, bagels and salmon were available…(Monday)

We hope you enjoyed this week’s edition. You can follow us on Twitter @CapitolAccount and on LinkedIn by clicking here.