Talking Fintech; Gensler Tries to Shift the Crypto Narrative; CFTC Draws Interest

Capitol Account: Free Weekly Edition

No surprise, there is a lot going on in financial regulation. The fallout from the election continued, as speculation about policy changes and appointments for the second Trump administration seemed to reach a fever pitch.

We dusted off the detailed blueprint released by the Treasury Department in 2017 and 2018 that gives a good indication of what may be in store. Meanwhile, one backwater agency is suddenly getting a lot of attention from the transition team — the CFTC. The crypto industry wants a say in who gets the top job.

Speaking of digital assets, we covered a narrative-shifting speech from the SEC chair. He offered a strong defense of his regulatory and enforcement approach. Our Friday interview, with a former Capitol Hill and Treasury staffer, focused on the outlook for fintech oversight.

Thanks for reading our digest of articles published this week. To get more stories like these in your inbox every weekday evening, click the button below to subscribe.

Friday Q and A: Nearly two weeks after the election, there’s still a host of unanswered questions about how a second Trump administration will approach financial services, especially when it comes to fintech. Donald Trump is getting his ear bent by leaders from Wall Street and Silicon Valley, but those constituencies don’t often see eye to eye when it comes to tricky policy questions. Personnel choices will be key – and so far at least – the president-elect hasn’t selected his team of overseers.

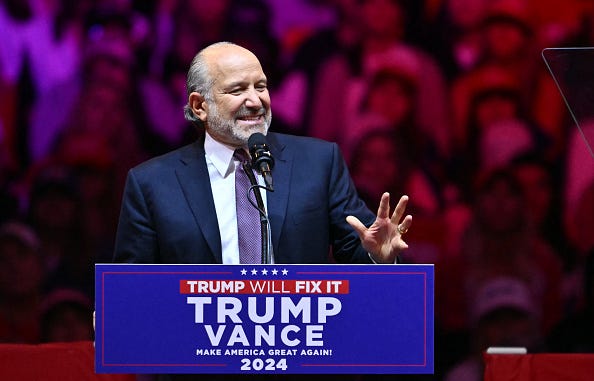

To get a better understanding of the dynamics at play, and what may be in store, we sat down this week with Jonah Crane. A veteran of both Capitol Hill and the executive branch, he worked on banking issues for Sen. Charles Schumer as the Dodd-Frank Act was written. Crane then moved to the Obama Treasury Department, where he delved into everything from Treasury market structure to hedge funds. He eventually served as the top staffer on the Financial Stability Oversight Council, before heading to the private sector.

Crane is now a partner at Klaros Group, where he advises banks and financial technology firms trying to navigate Washington’s regulatory morass. Read on for his take about the push-and-pull between different interest groups in Trump’s coalition, the challenges ahead for the crypto industry (despite its newfound influence) and what policies he sees surviving – or not – in Trump 2.0. What follows is our (lightly edited and condensed) discussion.

Capitol Account: Tell us about your background.

Jonah Crane: I'm a lawyer by training. I moved to D.C. at the tail end of the financial crisis in the summer of 2009, to work for Senator Schumer…We had something like 22 hearings in the banking committee my first month on the job.

CA: You got a crash course in financial regulation.

JC: It was mind numbing.

CA: What do you do as a consultant?

JC: It’s a mix of strategy and risk management…When you say consulting in D.C., sometimes people have other ideas – advocacy or [government relations]. It's a very different kind of practice. We focus almost entirely on the intersection of banking and Fintech…The whole idea is to bring to bear a range of experience and expertise to clients who are trying to navigate a lot of these difficult, uncertain regulatory environments.

CA: How are your clients processing the election?

JC: There are lots of assumptions about what's going to happen anytime you have an administration change. And then there's the reality about what's going to happen. The assumptions are usually much bolder and much clearer than what ultimately transpires on the ground. I think this was true in the last Trump administration. I think it's true now.

CA: Do you see a big shift in financial services policy?

JC: It's been clear in the last few administration changes, directionally, what was going to happen. A little bit less stringent regulation in a Trump administration and a little bit more stringent in Democratic administrations. But what that means on the ground will really depend a lot on where the agencies and the new agency leadership decide to spend their time and focus their priorities.

CA: Partnerships between banks and fintech firms have been a focus recently for Biden regulators. Do you expect anything different on that front?

JC: This is one of those areas where I think there's a lot of inertia to what the regulators are doing, and also it's not a particularly partisan issue. There's broad recognition that we can improve the way that these partnerships are overseen…and that's going to require some additional guidance. I think the regulators were already going in that direction.

CA: So slow and steady progress?

JC: If there are people in the fintech world who think it's going to be a free-for-all because there's a Trump administration now, I push back pretty strongly on that. This is an area in particular where the banks are not particularly interested in a free-for-all.

CA: Where do you see a broader overhaul when Republicans take over?

JC: The SEC and the CFPB are the two financial regulators where we are going to see the biggest changes of direction. If you look at the unified regulatory agenda and you look at their outstanding proposals, the unfinished work of those agencies, I would expect large chunks…to be shelved.

CA: What could get thrown out at the CFPB?

JC: A lot of people have commented that the credit card late fee proposal will be withdrawn in some fashion. The bureau can simply choose to stop defending it in court. They could formally withdraw it…I have real questions about things like the Fair Credit Reporting Act [rules] that the bureau is going to work on to complement the [open banking] rule. Some of the other privacy initiatives the bureau was working on, I assume, will at least be paused and rethought.

CA: With Republicans now controlling Congress, do you see any prospect of revising the CFPB’s structure, such as turning it into a commission?

JC: I think both sides like being able to just fire the director and replace the director quickly when the administration turns over now, and commission structures complicate that greatly…I'm not sure there are great incentives to go monkeying with the structure.

CA: What’s likely to happen at the SEC?

JC: A huge chunk of their agenda will be reconsidered.

CA: One thing the SEC was criticized for not doing was setting rules for digital assets. How does that play out now?

JC: This is an area where there will be a bit of a direction from the top. The Trump administration will want to show their crypto supporters that they're doing something to deliver. But exactly what form that takes? TBD.

CA: Crypto firms are pretty ecstatic about their opportunity to influence the debate.

JC: The big question is going to be: Now that they've got some influence, what do they want? And can they coalesce around something either for the regulators or for the Hill to work on that would be constructive for the industry? This is where the folks in the industry who earnestly want clear regulatory frameworks and those who would rather avoid clear regulatory frameworks…those divisions may start to come to the fore.

CA: Similar to how big banks often like regulation because it wards off competition?

JC: I think that's right. These tensions within the industry have been beneath the surface for a while because the industry's been able to rally around something of a common enemy – [SEC Chair Gary] Gensler in particular, but the Biden administration more generally.

CA: What did you think of the approach to crypto over the last four years?

JC: We've had a missed opportunity. The banking regulators started their policy sprints a few years ago and felt like they really needed to get up to speed and figure out how, if at all, some of these crypto activities could take place in and around the banking system. And then 2022 and FTX happened, and they said, ok, never mind. Let's put that back on the shelf. The big risk is that here we are, clearly at the outset of another bull market or boom in the crypto world. Regulators are back behind the eight ball…(Friday)

Click here to subscribe and read the rest of the interview.

Thanks for reading. Follow us on X @CapitolAccount and on LinkedIn by clicking here. We’re always looking for stories, so if you have any suggestions on what we should cover (or comments about Capitol Account), shoot us a note. Rob can be reached at: rschmidt@capitolaccountdc.com and Ryan at rtracy@capitolaccountdc.com. If somebody forwarded this to you and you’d like to subscribe, click on the button below. Please email for information on our special rates for government employees, academics and groups: subscriptions@capitolaccountdc.com.

Shifting the Narrative: Gensler is well known for filling his speeches with history. On Thursday, he tried to write a bit of his own – especially when it comes to his record on digital assets.

Speaking at a securities law conference in New York, the SEC chair was in a reflective mood and contemplating his departure, telling the crowd, “Yeah, you are going to get a little legacy tour here.” He touted accomplishments ranging from bolstering the Treasury markets to revamping stock trading rules.

But Gensler’s effort to explain, and defend, his crypto approach stood out. (He knew it would, too, underscoring that it comprised 10 percent of his speech but “98 percent of what the press [will] report on.”) The argument was perhaps an attempt to shift the narrative on the issue for which he may be best remembered. Its crux: I didn’t do much differently than my Republican predecessor Jay Clayton, and we were simply following the law.

“Jay had already brought some 80 actions in the crypto field,” Gensler said, highlighting the major lawsuit the agency brought against Ripple in Clayton’s last week in office. “The SEC has continued that vigilance, not just under Jay’s leadership, but when I’ve been there.”

Since 2018 – three years before he arrived, Gensler emphasized – digital assets cases have comprised between five to eight percent of the agency’s enforcement docket. And for those who argue that the SEC has been overreaching? The SEC chief maintained that “court after court has agreed with our actions.”

Gensler also sought to rebut the notion that he thinks every token is a security subject to the SEC’s rules. “Former Chair Clayton and I both said bitcoin is not a security,” he reminded the audience. The commission’s “focus rather has been on some of the 10,000 or so other digital assets.”

Interestingly, Gensler took pains to stress some positives as well – notably the commission’s approval of bitcoin and ether exchange traded funds under his watch. (Left unmentioned was the court case filed by Grayscale Investments that forced the SEC’s hand.) The chair contrasted the ETF decision with Clayton, who rejected a number of requests to offer the products when he was in charge. “We initially followed in our predecessor’s process,” Gensler explained…(Thursday)

Click here to subscribe and read the rest of the article.

Hot Spot: The CFTC may not be a regulatory backwater much longer, if the president-elect’s allies have anything to say about it. The perpetually underfunded agency, which often plays second fiddle to the larger and more prominent SEC, is drawing a surprising amount of attention from the Trump transition team – a sign that the derivatives overseer could be in for a major shake-up next year.

Much of the interest, sources say, is fueled by cryptocurrency proponents who have long pushed for the CFTC to be the main regulator of digital assets. Toward that end, a number of prominent executives and lawyers who represent the industry are said to be in the mix to lead the commission. They include Marco Santori, the chief legal officer of Kraken, as well as several attorneys in private practice, the sources say.

Adding juice to the deliberations, Howard Lutnick, who is playing a key role in Trump’s transition work, has been particularly focused on the appointment, the sources add. Parts of the billionaire’s firm, Cantor Fitzgerald, are regulated by the agency. And on the crypto side, the company manages the reserves for the stablecoin Tether. Also notable: Lutnick’s new exchange FMX has been battling to break CME’s grip on clearing Treasury futures – a fight the CFTC is in the middle of.

“Lutnick running the translation team could not have worked out better for the agency,” says one person following the process. “He is super aware of what the CFTC has historically done.”

The Wall Street CEO, emphasizes another observer, “gets what the CFTC could be doing.”

The Trump team hasn’t made any promises to the crypto industry about regulatory appointments, sources say. Still, the massive amount of money that digital asset firms contributed to Trump and other Republicans this election has given them an open door when it comes to suggesting names.

One potential problem with installing a crypto executive atop the CFTC, people familiar with the discussions underscore, is that the person isn't likely to have expertise with the primary derivatives markets that the agency oversees. Toward that end, the industry has also pushed for some candidates with broader experience. They include two former officials at the commission, Neal Kumar, a partner at Willkie Farr & Gallagher, and Joshua Sterling, a partner at Milbank.

Kumar, interestingly, is being touted by ex-CFTC Chairman J. Christopher Giancarlo, who works at the same firm and has been an outspoken booster of digital assets. While some have wondered if Giancarlo would return to the agency, he’s been telling people that he is likely to get a job as “crypto czar” at the Treasury Department.

Jill Sommers, a former Republican commissioner, is also in the running and would be a popular choice as someone who knows both the building and the derivatives world, sources note…(Wednesday)

Click here to subscribe and read the rest of the article.