Talking Bitcoin ETFs; A Contrite SEC Faces Sanctions in Crypto Case; 2024 Themes in Financial Regulation

Capitol Account: Free Weekly Version

Capitol Account is back for 2024. We hope everyone had some down time over the holidays, because it is going to be a very busy — and eventful — year. See below for our take on the biggest emerging themes in financial regulation. No surprise, lawsuits are at the top of the list. The crypto industry, in particular, is starting off January with a bang: The SEC is set to approve the first Bitcoin exchange traded funds next week. We previewed the decision, which is one that Chair Gary Gensler had forced upon him by a federal court. Speaking of digital assets and the SEC, the agency is in hot water after its enforcement attorneys made “false and misleading” (in the words of a judge) claims in a case against a token company. For our Friday interview, we spoke with a Georgetown professor who has been following the Bitcoin ETF developments closely.

Thanks for subscribing to our free edition, a digest of articles we published throughout the week. The daily newsletter had many more. Click the button below to upgrade.

Friday Q and A: With the SEC poised to sign off on more than a dozen Bitcoin exchange traded funds as soon as next week, there is a renewed crypto fervor on Wall Street – and in Washington. But amidst the hype, there are plenty of unknowns. Will investors flock to the funds? Will the token’s price soar? Or crash? Will the ETFs finally vault digital assets into the investing mainstream? Could Gensler, who has spent much of his tenure railing against the industry, somehow pull the plug at the last minute?

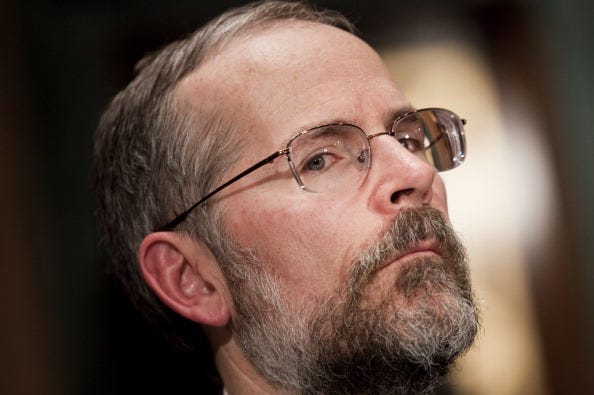

James Angel, a finance professor at Georgetown University, doesn’t have all the answers. However, he does have a lot of well-informed thoughts to share. Angel has been closely following the winding saga of the SEC’s approval process, submitting comment letters urging the agency to move forward and offering suggestions on how the ETFs should operate. He also joined a friend-of-the-court brief supporting Grayscale Investment’s successful lawsuit that paved the way for next week’s expected action.

Still, Angel is no cryptocurrency booster; he likes to say he is a “bit skeptic of Bitcoin.” His expertise ranges from investing to market structure to financial technology. Read on to get his take on the new products and their suitability for retail investors. The professor also reveals what he did over his holiday vacation (spoiler alert: it’s something that perhaps only an academic could enjoy). What follows is our (lightly edited and condensed) conversation.

Capitol Account: What’s your broad view on crypto investing?

James Angel: This is a space I've been following very closely for more than a decade now. At Caltech, I overlapped with a guy by the name of Hal Finney who was on the other side of the very first Bitcoin transaction. But I never really drank the Kool-Aid because I'd taken too many econ courses. We know what governments do to people who set up their own rival currency networks – shut them down real fast…I've been standing on the sidelines for over a decade, going: Man, did I ever miss my chance to be a billionaire.

CA: The SEC is facing a Jan. 10 deadline on this spot Bitcoin ETF decision. What do you think will happen?

JA: I don't have any special insight other than my reading of the tea leaves of all the media chatter and all the filings that are coming out. The consensus appears to be, yeah we're going to have a Bitcoin ETF. And the SEC is doing its best to maximize the hype around this.

CA: Seems like you think that is pretty ironic.

JA: Oh, yeah. This is Gary Gensler's worst nightmare come true, due to bureaucratic bungling. If they had just quietly allowed Grayscale to turn its [Bitcoin Trust fund] into an ETF years ago, we wouldn't be having this talk. There would be a couple of Bitcoin ETFs out there, a couple of crypto ETFs, and the crypto fanatics would be trading back and forth. But what the SEC is doing is setting up a horse race with the big ETF vendors, with all of their marketing muscle, standing there at the starting line waiting for the pistol to go off.

CA: Sounds like it could be interesting.

JA: The SEC is unleashing the marketing might of the entire Wall Street – all at once. We are going to see the mother of all marketing battles. We're going to see a lot of direct and indirect advertising.

CA: What’s the big worry for the agency?

JA: If you look at recent data, Bitcoin tends to be fairly highly correlated with the Nasdaq and the S&P. And it's highly volatile, with very uncertain returns. What the regulators fear is when Mr. and Mrs. 401k – to use a [former SEC Chairman Jay] Clayton-ism – decide, `Wow, I need to get onto this crypto bandwagon. Look at all this stuff from BlackRock and Fidelity and the others. These are legitimate companies that have had lots of five-star mutual funds over the years, and now they're advertising the crypto fund. I should put my 401(k) into this. I should put my IRA into this’…If Gensler wanted to hype crypto, I don't think he could have done a better job.

CA: But the agency is taking this approach so that it doesn’t give any one firm a head start.

JA: This is one of the problems in financial innovation. If you think about intellectual property, if you write a new book, it's your property. You can decide what to do with it. If you invent a new invention, you can patent it. If you invent a new financial product, shouldn't you have some period of exclusivity where it's yours? I would think that the folks who've been at this for five years, who've presumably spent millions on legal fees, probably should...This is a debate we need to have. And I don't think anybody has really looked at it yet.

CA: Are you surprised that so many big names in asset management plan to offer ETFs?

JA: Not at all. The street will sell anything they can make a buck on. That's what they do. The Wall Street firms help people trade. And if you look at it, a lot of the things they trade are highly speculative. We have hundreds of biotech companies that trade on Nasdaq, and a lot of these are going to go to zero. But some of them are going to be the next Moderna or the next Pfizer. We have all this riskiness that's built into our markets…The trading community has no problem at all with speculative assets.

CA: Do you have any advice for individual investors who will soon have this option?

JA: My basic investment advice is don't invest in things you don't understand. Ask yourself why somebody is going to be willing to pay more for it than you are today. Unless you just kind of enjoy speculating…If you want to play that game of musical chairs, have at it. But it's not the kind of thing I would say you should put X percent into your IRA plan… (Friday)

Thanks for reading. Follow us on X @CapitolAccount and on LinkedIn by clicking here. We’re always looking for stories, so if you have any suggestions on what we should cover (or comments about Capitol Account), shoot us a note. Jesse can be reached at: jwestbrook@capitolaccountdc.com, Rob at: rschmidt@capitolaccountdc.com and Jessica at: jholzer@capitolaccountdc.com. If somebody forwarded this to you and you’d like to subscribe, hit the button below. Please email for our special rates for government employees and academics, and group discounts for businesses: subscriptions@capitolaccountdc.com

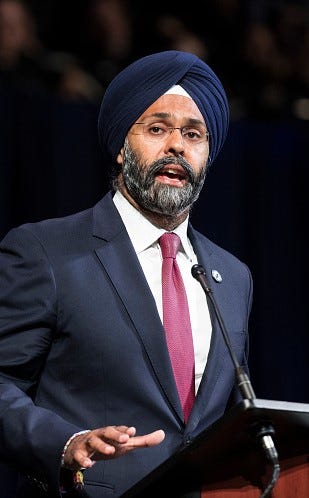

Trouble in Utah: The SEC’s enforcement chief has ordered mandatory training for his division’s lawyers, investigators and accountants as the agency scrambles to avoid being sanctioned by a federal judge for providing “false and misleading” assertions in a case against a crypto firm.

In a sign of how serious the situation is, Director Gurbir Grewal filed a personal apology with the court late last month, stressing the need to reinforce “the high standards to which we must adhere as government attorneys.” He concluded by emphasizing that it was his “responsibility to ensure that our attorneys execute their duties with skill and professionalism. On behalf of the division of enforcement, I deeply regret that division staff fell short of this standard.”

The extraordinary proceedings, which have been unfolding over the past few months in U.S. District Court in Utah, provide a rare glimpse into the power that the commission’s enforcement lawyers can wield against companies accused of fraud. The episode, which so far has received scant attention in Washington, also seems likely to reverberate on Capitol Hill where Gensler’s tough policing tactics against digital asset firms have come under scrutiny by lawmakers.

The dispute centers around an emergency temporary restraining order that froze the assets of a company called Debt Box and a number of its executives. The agency accused the firm in August of selling unregistered securities it called “node licenses” that were designed to produce profits by mining tokens. The defendants, the SEC alleged, were involved in “an ongoing, sprawling, fraudulent” offering, which “defrauded thousands of investors of at least $49 million.”

Chief Judge Robert Shelby granted the SEC request for the freeze at the end of July; it was made at an “ex parte” hearing before the case was unsealed – meaning it was done in private without defense counsel present. The judge extended his order several times before it was challenged in September by the defendants. The following month, Shelby took the highly unusual step of reversing his decision, giving the defendants’ access to their money and winding down a receivership that had been put in place.

The judge cited several instances where the commission had made false or misleading claims to bolster their case for the emergency action. They included an assertion that the defendants had closed 33 bank accounts in 48 hours, and another that the firm was “currently in the process of attempting to relocate assets and investor funds overseas.” Defense lawyers, however, produced documents showing none of that was true. And, Shelby noted, a number of the accounts were actually shut down by banks after they got subpoenas from the SEC – not by the company or the executives.

On Nov. 30, the judge issued an opinion explaining his decision, and asking the commission to show why it shouldn’t be sanctioned. Shelby wrote that he was especially troubled because the representations were made by a federal agency, without the other side present. He also pointed out that the asset freeze was a very significant enforcement tool. “Given the extraordinary power conferred by the [temporary restraining order], the court is mindful of how it was obtained,” Shelby wrote.

In a response submitted on Dec. 21, the SEC went out of its way to be contrite. Sanctions aren’t warranted, it argued, because the representations made by the attorneys were mistakes, and weren’t offered in bad faith… (Thursday)

Looking Ahead: Welcome to 2024. As the SEC, the banking agencies and the CFPB move to adopt some of the most prominent (and controversial) rules on their agendas, it promises to be a year of finalization. And while the description may be apt, it’s also a bit of a misnomer. There’s not likely to be a lot of finality – at least until the federal courts have their say. Lawsuits, even more than rules, will be the enduring theme in the coming months.

While the industry used to be nervous about suing regulators, that isn’t the case now. Business groups have already filed a half dozen legal challenges to SEC Chair Gensler’s rules, and more have been promised on the big ticket items he hopes to complete this year. That includes new regulations on climate disclosure, market structure and mutual fund pricing. Banking trade associations have also threatened to sue over the capital increases proposed in the Basel endgame plan. CFPB chief Rohit Chopra is likely to find his agency in court over its push to cap credit card late fees.

Adding even more uncertainty is the upcoming election, which promises once again to be too close to predict (or even guess). One thing that is clear, however, is that the Biden administration will need to move with haste to protect its policies from being overturned if Republicans take the White House, Senate and House. The Congressional Review Act gives lawmakers 60 legislative days to pass a measure disapproving rules. To ensure that doesn’t happen next year, major regulations likely need to be wrapped up sometime in June (the deadline is tricky and can only be estimated right now because it depends on how many days Congress is in session).

“This is going to be year of hurry up and then wait,” predicts Tom Quaadman, executive vice president at the U.S. Chamber of Commerce’s Center for Capital Markets Competitiveness. “Regulators are going to try to get as much done by mid-April as they can, and then the foot goes off the accelerator because of potential CRA and the elections.”

The chamber recently got a big win when the U.S. Court of Appeals for the Fifth Circuit vacated an SEC rule on stock buybacks, finding that the agency failed to respond to public comments and conducted a flawed cost-benefit analysis. The litigation underscores that agencies “can’t necessarily rush things, they have to follow the process,” says Quaadman.

Other opponents of the Biden regulatory push, who have also filed lawsuits in the same court, hope the decision is a harbinger. Even if it’s not, there is still the Supreme Court looming. Its 6-3 conservative majority, has shown a willingness (and perhaps an eagerness) to rein in the administrative state. The justices are likely to issue several important decisions this year that could limit the power of federal agencies.

What follows are some of the storylines and issues we’re watching most closely as the year begins… (Tuesday)

If you like what you’ve read, 2024 is the year to sign up for the daily newsletter: