Capitol Account Turns Two - And Has a Gift for You

Free content next week! Plus, our weekly digest of stories.

Capitol Account is celebrating our two-year anniversary. And we’d like to give you, as dedicated readers of our free Saturday edition, a gift: a week of our paid newsletter. Start looking for it in your inbox Monday evening. We hope you enjoy the coverage and will consider subscribing for the long term (or at least the next year).

For us, this is a milestone – and we’re pretty proud of how far we’ve come. Thankfully there has been a lot to write about. Gary Gensler has plowed ahead with the biggest rulemaking agenda in the SEC’s history. There’s been a mini-banking crisis – and a lobbying frenzy to scale back new capital rules. The scandal at the FDIC, of course, has provided a lot of copy.

Throughout, we’ve worked to spot – and clearly explain – emerging trends. We’ve closely followed the sue-your-regulator craze, Washington’s war on hedge funds and the backlash against the Basel endgame from all sides.

We cover rulemaking — and the rule-writers — in a way that no other publication can match. Our readers were among the first to know about concerns within the Fed about the Community Reinvestment Act overhaul, the industry’s growing alarm over a seemingly anodyne rule for safeguarding customer assets and the SEC’s decision to re-propose standards for brokers’ use of artificial intelligence, among other scoops.

We try to have fun, too. See our stories that gave a rundown of Michael Barr’s reading list and Patrick McHenry’s self-deprecating bow tie jokes.

Enjoy this upcoming free week of Capitol Account, on us. You’ll be joining a list that includes senior regulatory officials, lawmakers, congressional staff, top lobbyists, financial executives and (no surprise) a lot of lawyers. We are always aware of the high bar our readers set for our coverage and it’s a privilege to write stories for them every day.

Now, on to the weekly digest. In lieu of our Friday Q and A, this week we published a recap of a fascinating discussion by three former SEC chiefs — and Gensler — on the agency’s 90th anniversary. We checked in on the FSOC’s AI confab (short version: Lots of talk, no action) and analyzed the SEC’s huge court loss on its private funds rule. Read on for some highlights.

Birthday: The SEC, famously busy under Gensler, took a bit of a respite Thursday afternoon to celebrate its 90th anniversary. The main event was a discussion that Gensler led with three of his predecessors, Richard Breeden, Mary Schapiro and Mary Jo White. Another panel focused on the history of the agency, and featured the granddaughter of Joseph Kennedy, the first chairman.

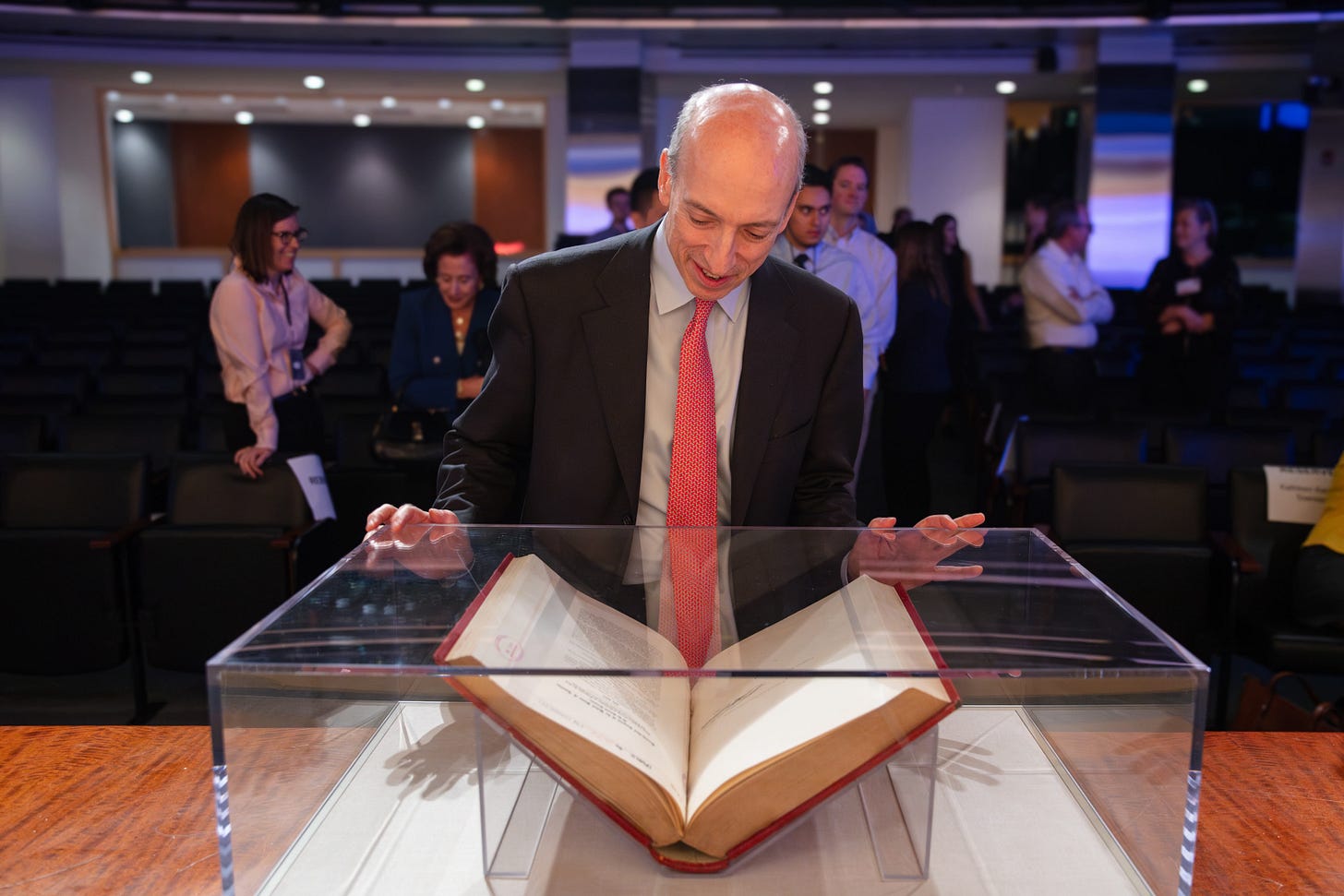

Though it wasn’t exactly a roaring party, the gathering drew a standing-room-only crowd of staff members (and a few alumni) to the agency’s basement auditorium. To be fair, Baskin-Robbins was served. But the real draw seemed to be an original copy of the Securities Exchange Act of 1934, brought over by the National Archives. The line for pictures (no flash allowed) was longer than for the ice cream.

What follows are a few excerpts from Gensler’s talk with the former chairs, who all seemed to be in good spirits. The four hit on a lot of interesting topics – what it’s like to be a regulator, dealing with congressional testimony, brushing off industry titans and keeping a distance from the White House. Breeden was nominated by President George H.W. Bush, and both Schapiro and White were appointees of President Barack Obama. (We‘ve edited out some verbal tics just for ease of readability.)

Most significant era for the commission?

Breeden: “For me, at least in the era before I became chairman, the most significant era was probably beginning with [Chairman] Ray Garrett, who in 1975 deregulated commissions on stock trading. Up until then, the trading of stocks in New York was a little bit like trading commodities in the movie `Trading Places.’ It was a very much unique, and small, focused system. The commission in that era presided over breaking that apart and breaking up the club, and beginning to open up capital markets to America…[It] wasn't what we have in the mass scale today, but was the beginning.”

White: “The founding era under Joseph Kennedy. I mean, writing a statute doesn't do it. You have to make the agency work, survive, have credibility. And then frankly, every other era that followed, that maintained the SEC as a very strong agency – and sometimes against really high odds, all odds. I think, Mary, you get a particular shout-out in that regard for your tenure following the financial crisis and Bernie Madoff, and saving the agency in many ways…If I were to single out an era that I think was particularly productive…it would probably be the late Harvey Pitt’s era when Sarbanes-Oxley came into being after Enron.”

Breeden: “Pivotally, John Shad, who served for seven years under Ronald Reagan, and who, among other things, was the true godfather of Edgar. It's hard to imagine today [but] before Edgar, to find out information about public companies or about tender offers, you had to send someone to a public library.”

That prompted White to quip: “That's the kindest thing said about Edgar in a century.”

`A wasting asset’

Gensler noted that when he was seeking advice about the job, Breeden told him: “Remember every day as chair is another day closer to you becoming a member of the former chairs’ club.” The panel then discussed what that means.

Breeden: “My prior government service had taught me, don't put off to tomorrow what you can do today. Because you have a window when you serve here to do good, and hopefully to do immense good. It's an awesome thing to think that you can benefit hundreds of millions of people that you'll never meet, but help make their lives better. Every day is a privilege, but is also a wasting asset.”

Gensler: “I couldn't agree with you more. It's such a remarkable privilege to be here, and you can affect hundreds of millions of people's lives for decades to come. But also time is the most scarce resource, in policy making and politics as well.

Market regulators versus prudential regulators

Perhaps not surprising for a gathering of former leaders of the overseer of the securities markets, there was a bit of throwing shade on their brethren that supervise banks.

Schapiro: “What sets us apart is enforcement. This was an issue we talked about a lot during Richard's tenure, the way prudential regulators approach violations by their institutions …

Breeden, interrupting: “Or don't approach.”

Schapiro: “Or don't approach. Compared to the way we do at the SEC, it's just worlds different.

compared to prudential regulators.”

Independence of the SEC

Gensler asked the group if they ever had the White House, the Justice Department or the Treasury “challenge your independence?”

White: “On the independence issue…it's frankly one of the main reasons I agreed to be…be nominated and appointed as the chair. I was telling the story of when I was announced as the nominee to succeed Mary, and Elisse [Walter], President Obama said, `Congratulations, Mary Jo. I'll speak to you again in four years when we're both out of office.’ Because he was honoring that independence of the agency. And he did.”

Shapiro: “I think there were only two real moments for me. One was…when the White House called a little upset about proxy access because they'd heard from lots of businesses that were really unhappy. The other was when the first draft of Dodd-Frank eliminated the SEC, and they had the decency to call me over to Treasury to tell me they were eliminating the SEC. Of course, we fought back against that. And it didn't come to pass.”

White: “No turf wars in this town at all, right?”

Click here to subscribe and see the full story.

Thanks for reading. Follow us on X @CapitolAccount and on LinkedIn by clicking here. We’re always looking for stories, so if you have any suggestions on what we should cover (or comments about Capitol Account), shoot us a note. Rob can be reached at: rschmidt@capitolaccountdc.com, Ryan at rtracy@capitolaccountdc.com and Jessica at: jholzer@capitolaccountdc.com. If somebody forwarded this to you and you’d like to subscribe, click on the button below. Please email for information on our special rates for government employees, academics and groups: subscriptions@capitolaccountdc.com

No Rush on AI Regulation: The Treasury Department hosted top industry and government officials for a conclave on artificial intelligence. And like so many AI-related events in Washington of late, there was a lot of talk, but little coalescing around tangible policy mandates.

The capital, of course, has been abuzz about AI since ChatGPT went viral in late 2022, supercharging adoption of the tech by consumers and businesses alike. Despite a ton of action, or maybe hype, not much has fundamentally changed. (In perhaps the highest-profile flop, Senate Majority Leader Charles Schumer led summits last year with the likes of Elon Musk and Bill Gates, but that process has so far yielded only a “roadmap” to legislation.)

Financial regulators, for the most part, have focused on explaining how their existing rules apply in an AI context. In one prominent case where an agency tried to write specific rules – the SEC’s proposal to regulate brokers’ use of predictive data analytics – the commission is now going back to the drawing board.

In the keynote speech, Treasury Secretary Janet Yellen didn’t appear keen to rush into anything. She described the tech’s benefits – better forecasting, portfolio management, detecting fraudulent or illicit transactions, automated customer support – while also noting that FSOC has identified AI as a potential vulnerability in the financial system.

“The tremendous opportunities and significant risks associated with the use of AI by financial companies have moved this issue toward the top of Treasury’s and the Financial Stability Oversight Council’s agendas,” Yellen stressed.

The “news” in the speech? Yet another Biden administration request for information on AI – this one asking how financial firms are using it, among other things. To the extent the document referenced policy changes, it did so with an open mind (and a bit of a progressive tilt):

“Please provide specific feedback on legislative, regulatory or supervisory enhancements related to the use of AI that would promote a financial system that delivers inclusive and equitable access to financial services that meet the needs of consumers and businesses, while maintaining stability and integrity, protecting critical financial sector infrastructure, and combating illicit finance and national security threats.”

Several panel discussions following Yellen’s speech were reflective of the “everything, everywhere, all at once” quality of the AI conversation in Washington these days. Experts from government, industry and elsewhere offered a flurry of examples of possible areas regulators should explore, including AI-driven discrimination, cyberattacks, frauds or even financial crises.

In many ways, the back-and-forth served to highlight the limits of policy makers’ reach. When federal watchdogs think about ChatGPT, for example, one thing they worry about is misinformation. The financial system, after all, is a confidence game, and false AI-generated content could undermine that shared trust.

But as some pointed out, that risk also doesn’t emanate from the firms the government oversees. Susan Baker, a systemic risk expert in the FDIC’s Division of Complex Institution Supervision and Resolution, told a story about articles online that contained false information related to the agency’s work. When the officials investigated, they found the same mistake on many other websites.

“It turned out to be somebody using a chatbot in the Philippines,” that replicated articles to harvest clicks, Baker said. “It kept repeating the mistake over and over again, and it was impossible for us to correct it.”

That scenario was somewhat innocuous, but “the nightmare…for financial stability doesn’t require big leaps of the imagination,” said Michael Hsu, acting comptroller of the currency, in a speech delivered after Yellen…(Thursday)

Click here to subscribe and read more.

Huge Win: After the first major legal fight over Gensler’s wide-ranging regulatory push, the scorecard now reads: Industry 1, SEC 0.

The unanimous decision from the U.S. Court of Appeals for the Fifth Circuit striking down a new disclosure regime for hedge funds, private equity and venture capital was immediately hailed by investment firms. And though it may not come as the biggest surprise given the pro-business leanings of the jurisdiction, the order is sure to reverberate – in other cases challenging SEC regulations and for rules still on Gensler’s to-do list.

“Today’s ruling is a significant victory for markets, fund managers and investors,” said Bryan Corbett, president of the Managed Funds Association, one of a half dozen trade groups that brought the litigation in September. “The court affirmed that the SEC cannot expand its authority beyond what Congress intended. Unfortunately, this is just one instance of SEC overreach as it looks to push through the most aggressive agenda in decades.”

Indeed, to many critics, who have described the slew of regulations aimed at the asset managers as a war on private funds, the decision is a validation of longstanding complaints about Gensler’s frenetic and boundary-pushing approach. They hope it’s a harbinger for several other pending suits on rules involving short-selling, Treasury trading, proxy advisors and climate disclosure.

“This is the beginning of these kinds of decisions, because all these rules that he’s promulgated are vulnerable,” says Hal Scott, an emeritus Harvard Law professor and head of the Committee on Capital Markets Regulation. “This is not a good sign for him.”

Scott, whose organization has opposed a number of Gensler’s policies, adds that this is likely the end of the line for the private funds rule. The agency will have a tough time digging up a different legal justification for the requirements. And an appeal to the Supreme Court, with its strong conservative majority, may be inadvisable. “Do you think you’re going to get a better result there?” he asks.

An SEC spokesperson said: “We’re reviewing the decision and will determine next steps as appropriate.”

The appellate panel’s decision was short (25 pages) and focused on arguments that the SEC didn’t have the authority to issue the rule. It took special issue with a section of the Dodd-Frank Act that the commission relied on, which the industry argued was meant to apply to retail traders – not sophisticated investors. The panel agreed, writing: “It has nothing to do with private funds.”

Interestingly, because it knocked out the rule on statutory grounds, the court didn’t weigh in on some other issues that have swirled around Gensler’s agenda and were raised in the lawsuit. That includes contentions that the effort didn’t comply with the Supreme Court’s major questions doctrine and that the commission didn’t properly conduct a cost-benefit analysis.

On the other side, the decision drew immediate condemnation from investor advocates who point out that the SEC rule was simply trying to get a bare minimum of information for investors in a fast-growing segment of an industry that now manages some $28 trillion. A good amount of that money, they say, comes from the retirement savings of ordinary people.

The ruling is “a terrible setback on many levels,” noted Stephen Hall, legal director at Better Markets, in a statement. “First and foremost, it will deprive investors in private funds – including everyday Americans with pension funds – of the protections the rule would have provided against unfair and opaque practices,” he said. “More generally it also will continue to weaken the SEC’s authority and ability to protect investors, financial stability and the integrity of our markets through its rules.”

Sen. Jack Reed stressed that the Fifth Circuit has “become a rubber stamp for special interests.” The Democrat added that he hoped the decision would be “swiftly” overturned…(Wednesday)

Click here to read more and subscribe.